capital gains tax increase 2021 uk

If your assets are owned jointly with another person you can use both of your allowances which can effectively double the amount you can make before CGT is due. Figures from the Treasury released in August show that its Capital Gains Tax receipts hit 98billion in the 201920 tax year up four.

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

0400 Sun Oct 24 2021.

. If the Chancellor equalised capital gains tax with the rates of income tax this would push the top rate of capital gains tax to 45 the income tax rate for additional rate taxpayers a rise of 25 for a higher and additional rate taxpayers. Will things likely change in 2021. First published on Tue 26 Oct 2021 1100 EDT.

You only have to pay capital gains tax on certain assets and do not have to pay it at all if your gains are under your tax free allowance which is 12300 or. Capital Gains Tax UK changes are coming. The biggest question asked of private client advisors over the past couple of years is when do we expect Capital Gains Tax CGT to increase.

For 2021-22 youll be charged at 10 on the first 1m of gains when selling a qualifying business the same as the 2020-21 tax year. By Charlie Bradley 0700 Thu Oct 28 2021 UPDATED. Long-Term Capital Gains Taxes.

Plus a change to the capital gains rules with a midyear effective date eg a 20 top capital gains rate for pre-April 2021 sales and a 396 top capital gains rate for sales. Asset sales have increased by around 2 to 115 of the tax revenue over the last 12 months largely. CAPITAL GAINS TAX will increase in the next couple of years to a 28 percent rate according to Nimesh Shah of Blick Rothenberg.

The government could raise an extra 16bn a year if the low tax rates on profits from shares and property were increased. OTS proposals suggested bringing Capital Gains Tax in line with Income Tax currently charged at a basic rate of 20 percent and rising to 40 percent for higher rate taxpayers. Capital gains tax UK.

Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. Tue 26 Oct 2021 1157 EDT. By Katey Pigden 27th October 2021 347 pm.

It comes amid ongoing silence from the Treasury around rumoured changes to Capital Gains Tax CGT which had been expected to feature in the Chancellors Spring Budget 2021 on 3 rd March. Many speculate that he will increase the rates of capital gains tax to help raise. Chancellor Rishi Sunak swerved making any major changes to the tax people pay when they sell assets such as a second home or shares.

40 Annual exempt amount UK. The capital gains tax allowance in 2022-23 is 12300 the same as it was in 2021-22. Corporation tax and capital gains tax are central to the governments plan to help address the deficit that is on its way to 400bn 559bn this year.

CAPITAL GAINS TAX is likely to increase and there could be major implications for some Britons an expert has warned ahead of the Chancellor Rishi Sunaks Budget. This is the amount of profit you can make from an asset this tax year before any tax is payable. Section 1L of TCGA 1992 which provides for an increase in the annual exempt amount to reflect increases in CPI does not apply for the tax years 2021-22 2022-23 2023-24 2024-25 and 2025-26 so that the annual exempt amount for each of those tax years remains at 12300.

Capital gains tax will be raised to 288 per cent by House Democrats. In his autumn Budget. Basic rate taxpayers would face an increase of 10 to 20 capital gains tax or higher rates on large gains treated as.

For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to. In the budget announced on Wednesday he revealed corporation tax will increase from 19 to 25 in 2023. However this could mean implications for far more people with some.

Entrepreneurs relief was slashed last April so that instead of being charged 10 on the first 10m of gains anything above 1m would be taxed at the usual 20. Changes to Capital Gains Tax UK are coming for 2021. Legislation will be introduced in Finance Bill 2016 to amend subsections 4 2 3 4 and 5 of TCGA to reduce the 18 and 28.

First deduct the Capital Gains tax-free allowance from your taxable gain. Capital Gains Tax changes that Self Assessment customers need to know. Alongside maintaining the Lifetime Allowance and Capital Gains Tax it is estimated the Treasury will raise some 204billion.

2021 to 2022 2020 to 2021 2019 to 2020 2018 to 2019. The average CGT bill is already 32000 and the tax rate could more than DOUBLE. Despite record levels of MA activity in the build-up to the Budget with Azets advising on 50 deals in just ten weeks no announcement was made and.

HMRC customers have until 31 January 2021 to declare any profit made from selling a UK residential property which was not. Youll owe either 0 15 or 20. 20 for companies non-resident Capital Gains Tax on the disposal of a UK residential property from 6 April 2015.

Once again no change to CGT rates was announced which actually came as no surprise.

Need To Report Cryptocurrency On Your Taxes Here S How To Use Form 8949 To Do It Bankrate

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Difference Between Income Tax And Capital Gains Tax Difference Between

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Capital Gains Tax What Is It When Do You Pay It

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

How To Reduce Your Capital Gains Tax Bill Vanguard Uk Investor

Selling Stock How Capital Gains Are Taxed The Motley Fool

How Does The Personal Representative Deal With The Income And Capital Gains Arising After The Deceased S Death Low Incomes Tax Reform Group

Difference Between Income Tax And Capital Gains Tax Difference Between

Selling An Inherited Property And Capital Gains Tax Yopa Homeowners Hub

Mutual Funds Capital Gains Taxation Rules Fy 2018 19 Ay 2019 20 Capital Gains Tax Rates Chart For Nris Mutuals Funds Capital Gain Fund

Uk Capital Gains Tax For British Expats And People Living In The Uk Experts For Expats

How To Calculate Capital Gain Tax On Sale Of Land Abc Of Money

What Are Capital Gains Tax Rates In Uk Taxscouts

Section 54 54f Income Tax Act Tax Exemption On Capital Gains

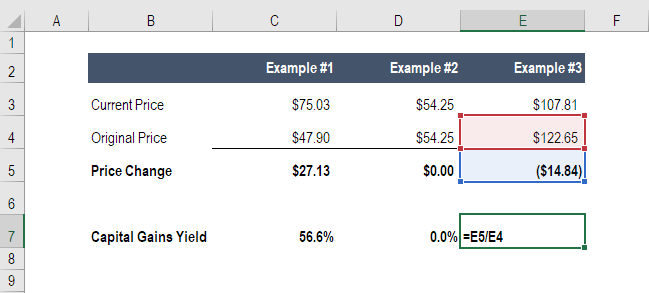

Capital Gains Yield Cgy Formula Calculation Example And Guide